Road traffic accident injury claims have seen a change since the introduction of the Official Injury Claim service in 2021. Introduced as part of the government’s Whiplash Reform Program, the OIC oversees minor RTA injury claims valued at less than £5,000 and aims to make claims easier for the injured party.

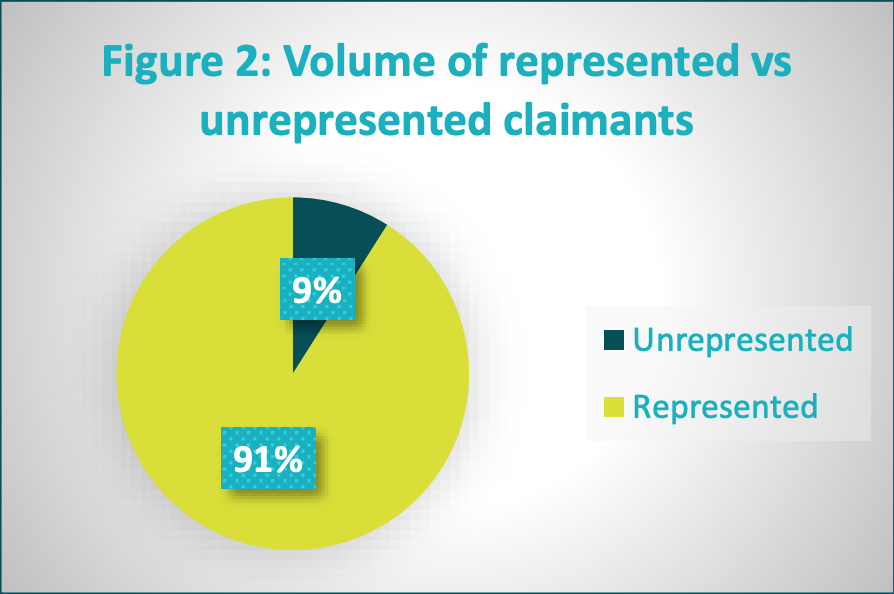

Recent reports on the workings and payouts of the OIC make for interesting reading. A quick look at the figures shows there are around 25,000 claims per month through the OIC, and nearly 91% of those are made by represented clients.

Represented clients now make 75% of settled claims, and the average settlement time is currently at 139 days.

The OIC was established to make the claim for minor RTA injury compensation easier and quicker for the client. By digging deeper into recent reports from the OIC, we can see how this works and how the client can benefit.

Table of Content

The OIC and RTA injury claims, a brief history

The Motor Insurer’s Bureau, MIB, established the OIC on behalf of the government. The OIC aims to use current government policy on RTA claims as a guide when deciding compensation amounts for personal injury in RTAs.

The OIC handles claims when injury amounts are less than £5,000 and overall damages, including loss of earnings and damage to the car and property, are no more than £10,0000.

A primary aim of the OIC is to simplify the claims process for Whiplash and similar road traffic accident injuries like minor lacerations. The OIC operates a fixed tariff of damages in these small claims where possible and raised the claim limit from £1,000 to £5,000.

The OIC came into operation on 31 May 2021 and has had more than 209,000 claims submitted since the launch.

What types of claims does the OIC handle?

The OIC handles the minor claims for injury, the types of RTAs with a typical claim value worth less than £5,000. You can follow a separate claims process for more compensation if you have an injury worth more than the £5,000 limit.

Types of claims handled by the OIC are:

| Claim types | Number of claims |

| Whiplash only | 20,029 |

| Whiplash + minor psychological | 9,389 |

| Whiplash + physical | 27,126 |

| Whiplash + physical + minor psychological | 24,388 |

| Multiple injuries | 6,794 |

| Physical only | 2,479 |

| Physical + psychological | 657 |

| Other | 77 |

Recent surveys show Whiplash is an element in the majority of RTA compensation claims handled by the OIC. 96% of these claims include Whiplash as an injury, and claim amounts are set by the fixed tariff of damages assessed by the Civil Liability Act 2018.

The fixed tariff for Whiplash injury, as set by the CLA, sees claims for Whiplash injury ranging from £240 to £4,345 depending on the duration of the effects of the injury.

| Duration of injury | Amount – Regulation 2(1)(a) | Amount – Regulation 2(1)(b) |

| Not more than 3 months | £240 | £260 |

| More than 3 months, but not more than 6 months | £495 | £520 |

| More than 6 months, but not more than 9 months | £840 | £895 |

| More than 9 months, but not more than 12 months | £1,320 | £1,390 |

| More than 12 months, but not more than 15 months | £2,040 | £2,125 |

| More than 15 months, but not more than 18 months | £3,005 | £3,100 |

| More than 18 months, but not more than 24 months | £4,215 | £4,345. |

2.—(1) Subject to regulation 3—

(a)the total amount of damages for pain, suffering and loss of amenity payable in relation to one or more whiplash injuries, taken together (“the tariff amount” for the purposes of section 5(7)(a) of the Act), is the figure specified in the second column of the above table.

(b)the total amount of damages for pain, suffering and loss of amenity payable in relation to both one or more whiplash injuries and one or more minor psychological injuries suffered on the same occasion as the whiplash injury or injuries, taken together (“the tariff amount” for the purposes of section 5(7)(b) of the Act), is the figure specified in the third column of the above table.

Do you need legal representation to make an OIC claim?

You do not need legal representation to make an OIC claim, but it certainly helps the process move smoothly, quickly, and efficiently.

Overall, 91% of claimants using the OIC process are now represented by some form of legal expertise. The remaining 9% choose to represent themselves with all that entails.

Recent survey data shows that legally represented claimants settling claims has risen to 75% of overall settlements made, up from 48% in previous periods.

The majority of OIC claimants use an established law firm to represent their interests with the OIC, or an ABS, Alternative Business Structure. Some claimants, a very small minority, use a Claims Management Company, CMC, when choosing representation.

| Type of user | Number of claims | Percentage |

|---|---|---|

| Law firm | 65,998 | 76% |

| ABS | 20,609 | 23.8% |

| CMC | 198 | 0.2% |

| Other | 0 | 0% |

Claim settlements made using the OIC

Claim settlements made using the OIC continue to rise over every accounting period. As claimants see how the service works and how their injuries are reflected in the fixed tariffs, they see the benefits of the OIC.

On the same side, those liable for injuries in an RTA see the OIC at work, and from experience, insurance companies also see the benefits of following the fixed tariffs.

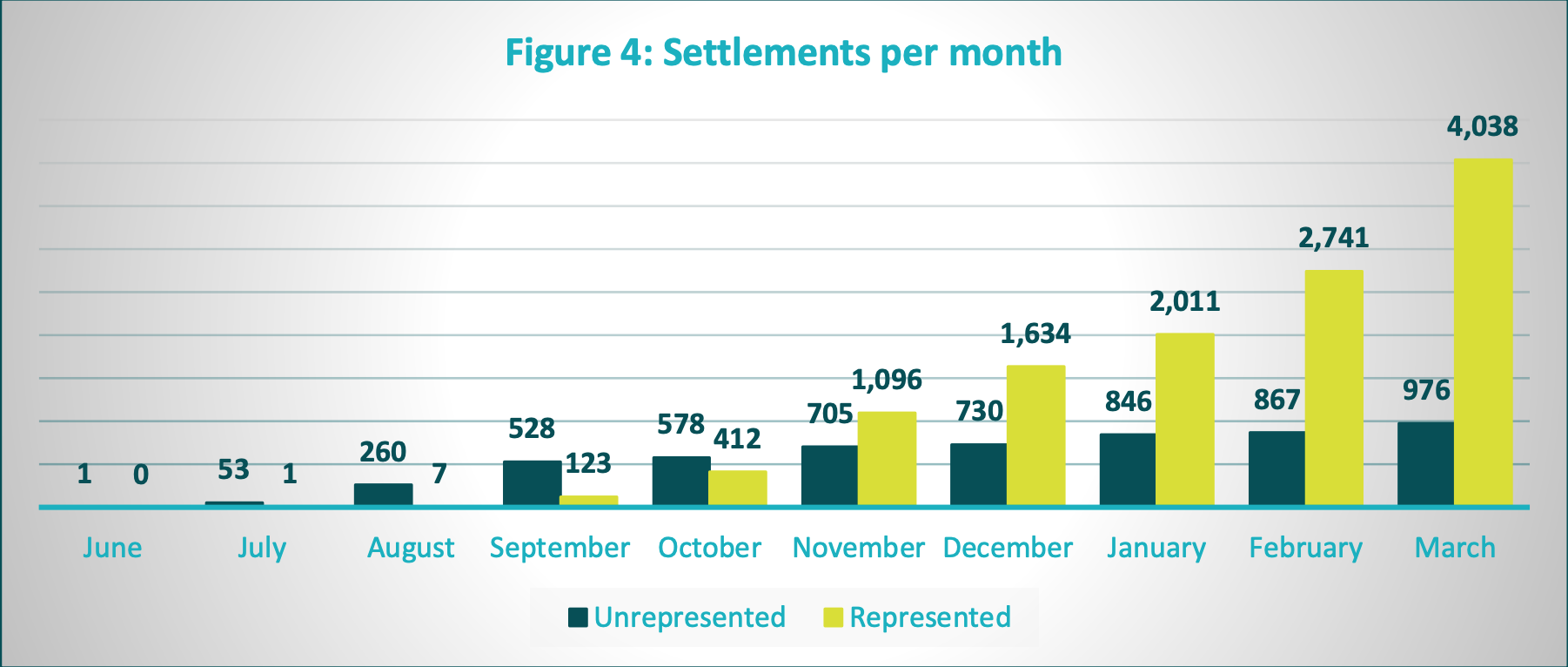

Recent surveys show more than 17,000 claims have been settled using the OIC since its inception in June 2021. The rise in representation is reflected in the rise of settled claims, with more than 75% of settled claims having a form of legal representation.

The time taken to settle a claim is also on the rise. Average claim time, from making the initial claim through the OIC to final settlement, is now reaching 139 days.

The rise is to be expected with more claimants using the system, cases maturing and probably with more RTAs, as more people are on the road since the lifting of Covid restrictions.

If anything, the claim time will continue to rise as the service becomes busier, but legal representation can help speed up the process.

How are claims being settled within the tariffs?

Claims are, on the whole, being settled within the first three tariffs. The tariffs are broken down into three, six and nine months, covering how long it takes the claimant to recover from their RTA injuries.

51% of claims are settling in the three-to-six-month tariff and 28% in the six-to-nine-month tariff. With a further 14% settling in the first three-month tariff, most claims, 93%, are currently settling within the first three tariff bands.

It is good news for those claiming compensation after an RTA where their injuries clear in less than a year. The claimants have suffered pain and inconvenience in an accident that was not wholly their fault but can still claim compensation from those responsible in a timely manner.

There is little difference between what represented claimants and unrepresented claimants settle for on average when using the OIC process. Early settlements are usually in everyone’s favour and can shorten the time for claimants using the OIC.

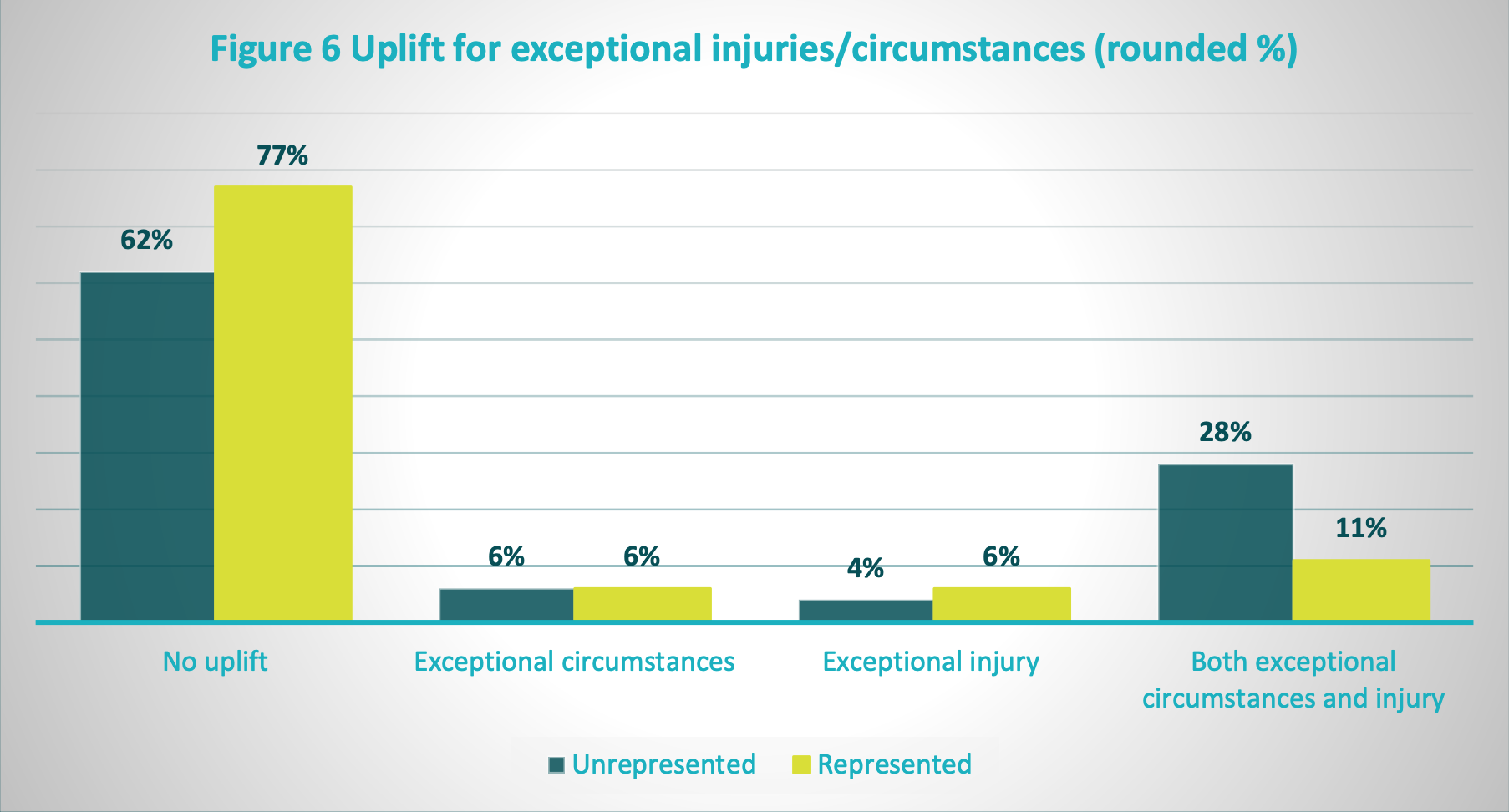

| Type of representation | No uplift claimed | Exceptional circumstances uplift claimed | Exceptional injury uplift claimed | Both exceptional injury and circumstances uplift claimed |

| Unrepresented | 5,222 | 491 | 372 | 2,376 |

| Represented | 67,058 | 5,361 | 4,736 | 9,650 |

What about claims for personal injury above the tariff guidelines?

When the claimant has a personal injury above the tariff guidelines due to the severity of the injury, exceptional losses, or an impact on their home or work life, they can apply to a court for what is known as an uplift.

An uplift claim may be agreed by the OIC when the claimant may have suffered a more severe than the usual level of injury covered by the tariffs. Exceptional injuries may be Whiplash lasting longer than 12 months or constant headaches and pains.

A claimant can request an uplift, too, when seeking damages for exceptional circumstances affecting their life after an RTA. The exceptional circumstances can be an impact on the home life, social life or work life due to the severity of the accident.

38% of unrepresented claims seek the uplift when circumstances merit it. Of represented claims, around 23% seek the uplift when using the OIC process.

Claimants can seek the uplift for exceptional injury or exceptional circumstances, or they can pursue one for a combination of both reasons.

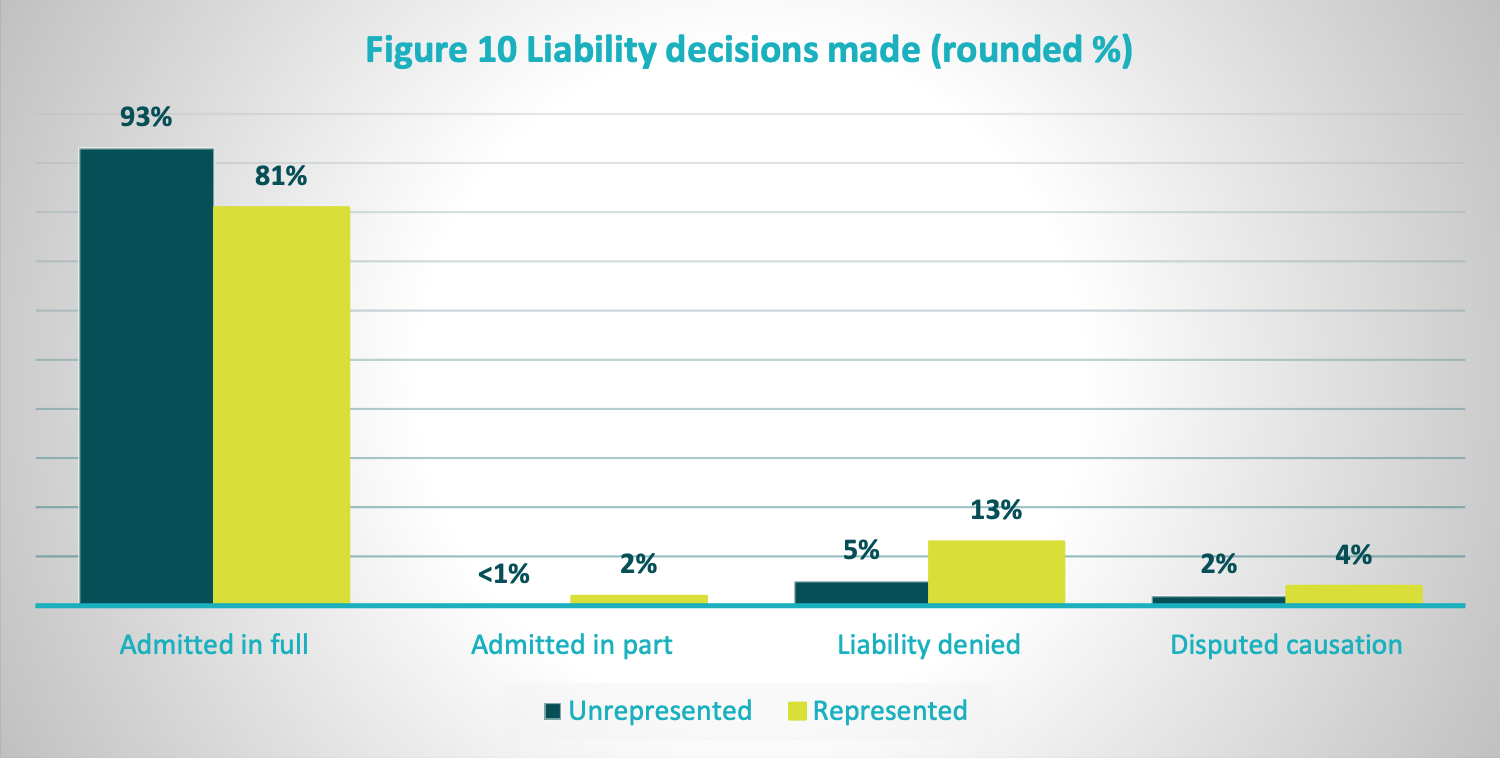

| Liability in full | Liability in part | Liability denied | Disputed causation | |

| Represented claimants | 46,237 | 999 | 7,539 | 2,048 |

| Unrepresented claimants | 4,824 | 28 | 251 | 90 |

Admitting liability in a road traffic accident

Admitting liability in a road traffic accident is vital to settling a claim in a speedy and acceptable manner.

Once a party admits full or partial liability, the tariff process can award the appropriate compensation, and the claimant may get on with their lives.

93% of compensators admit full liability for the RTA in unrepresented claims, while the figure is 81% for represented claimants. In both sectors, the remainder either admit part liability for the RTA or deny liability. 4% of represented claims have a disputed causation, with 2% of unrepresented claims going down the same route.

The fixed tariffs used by the OIC can make it easier for claimants to seek compensation in RTAs. The clarity of the OIC also makes it possible for the compensator to admit liability at an earlier stage.

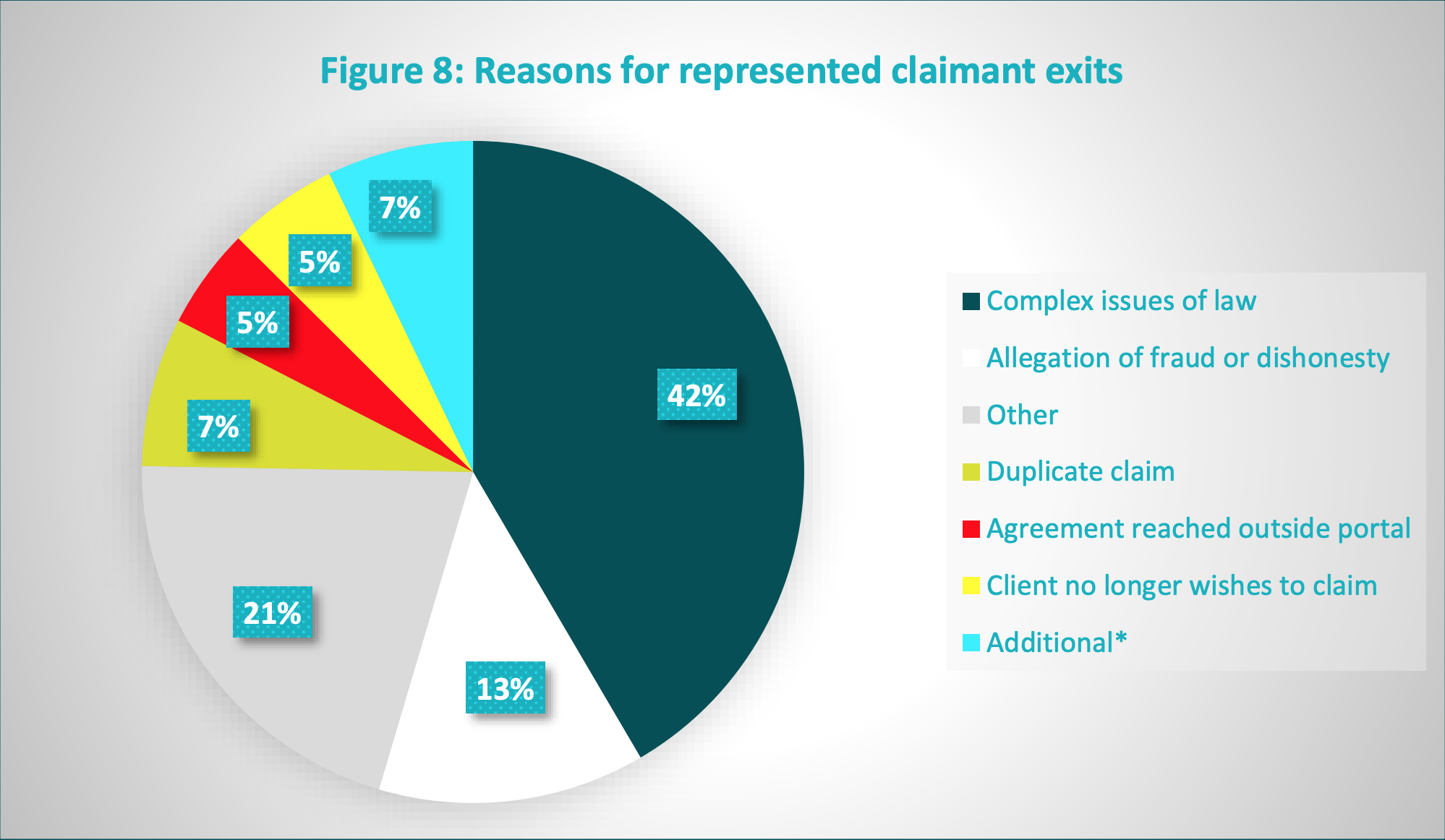

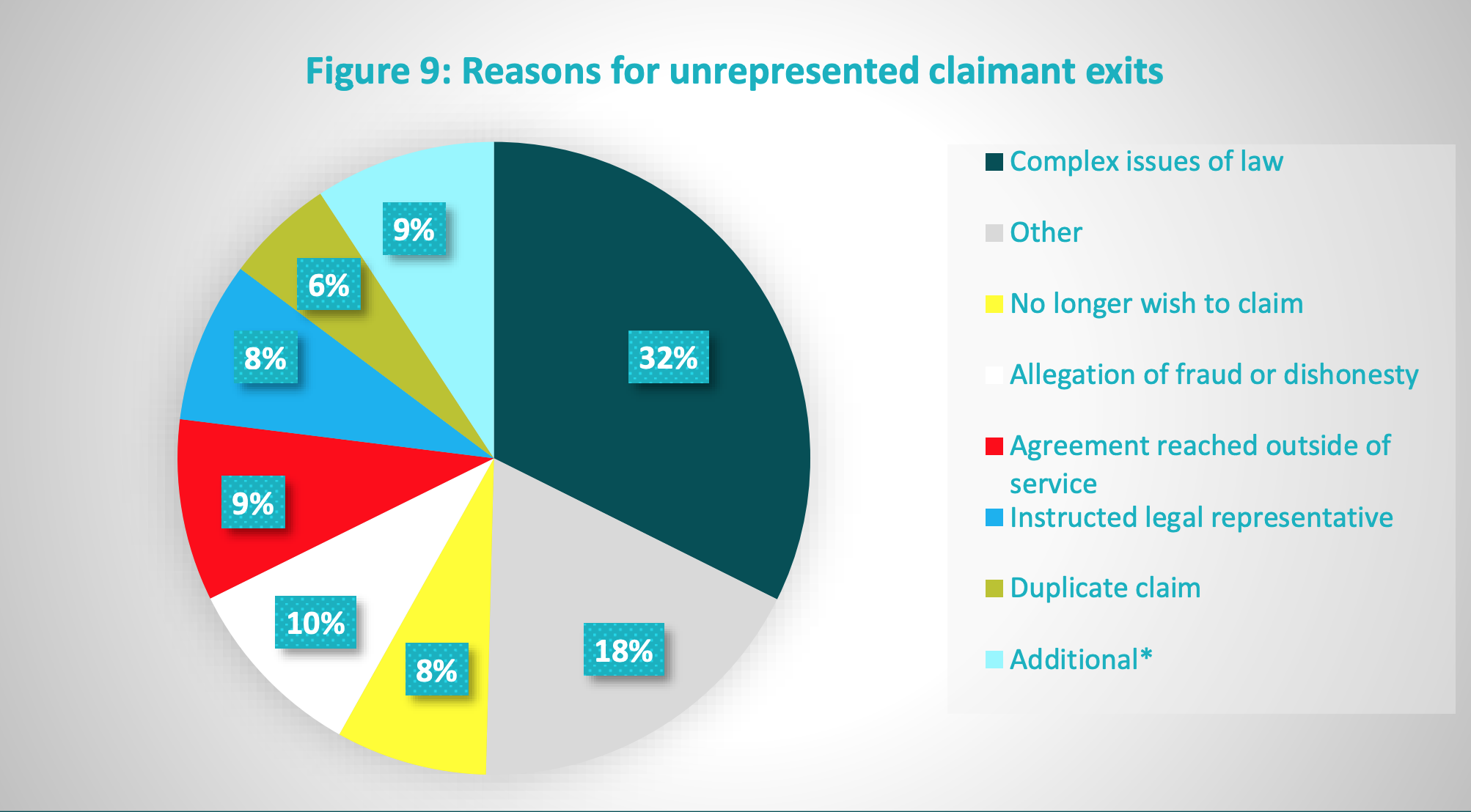

Can claims exit the OIC portal?

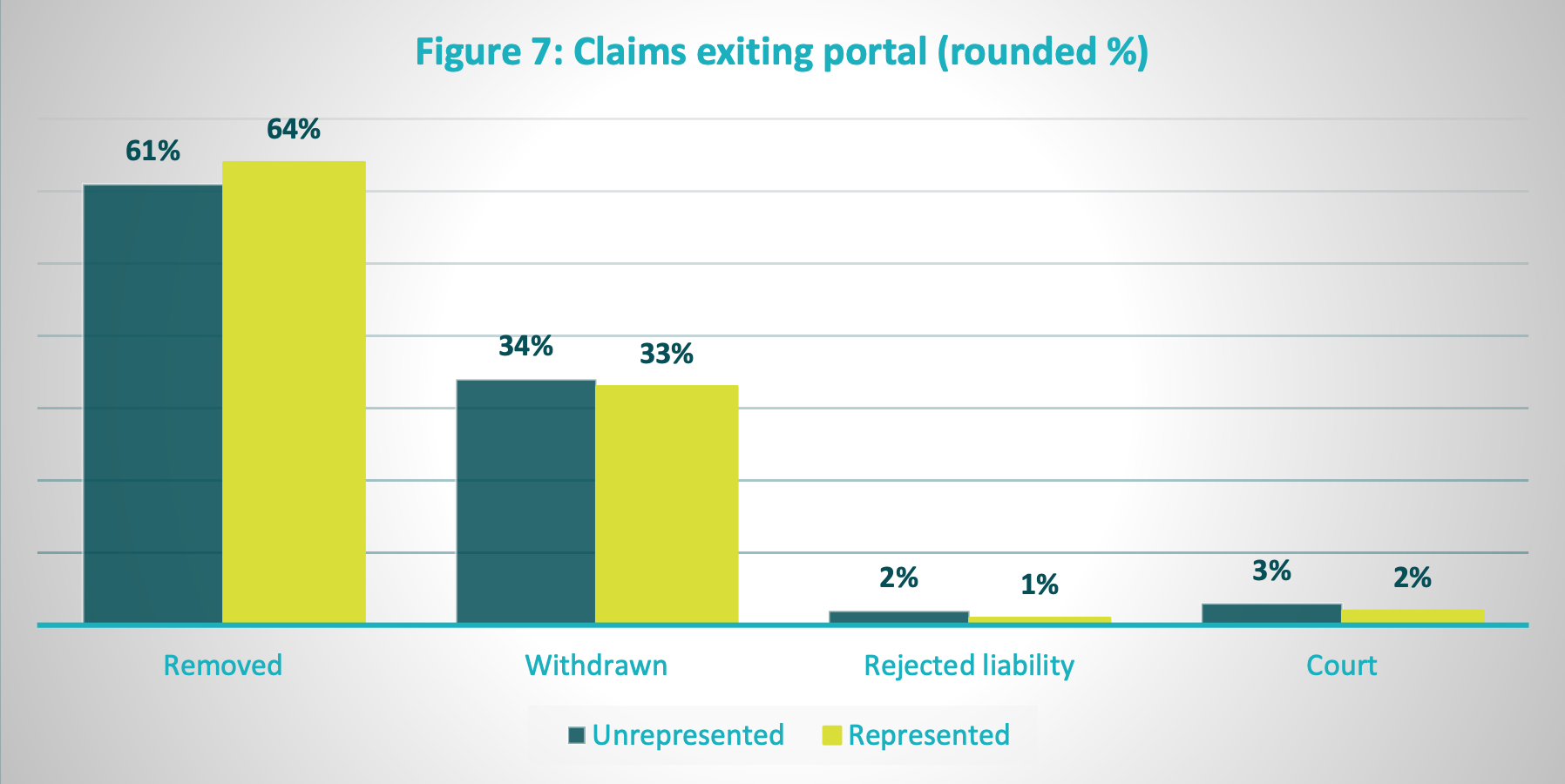

Yes, claims can exit the OIC portal at any stage of the process. The reasons for leaving the OIC portal are many and range from duplicate claims to allegations of fraud and claims going above the agreed tariffs and damages threshold.

A claim may also be settled when both parties agree to a settlement outside of the process or when a claimant no longer wishes to claim.

There is little difference between represented and unrepresented claims when it comes to leaving the OIC portal process. Both types of claims may choose to leave, and the OIC has an exit mechanism to ensure all sides are happy when leaving.

Using the OIC portal when you suffer an RTA injury

The OIC portal can be successful when seeking compensation after an RTA injury. The agreed tariffs under the new legislation compensate for the minor injuries that clear in less than 12 months and are proving useful to claimants.

The claimant can submit a claim using the online portal and can do so using representation or on their own. The process may get them the compensation they need when recovering from a minor RTA while the route to seeking more compensation stays open.

If you suffer injury in an RTA, you may be able to seek compensation for the effects on your life today and in the future. Legal advice is always recommended when submitting a personal injury claim, and you may choose representation when using the OIC portal.

The Personal Injury Team can help with your OIC claim for compensation and advise you on how to manage it.